College is a time of experimenting and preparing yourself for the real world. As someone who just finished college and is gearing up to make the transition from mostly independent to fully independent from my parents financially, there are lots of things that I am glad I did financially to set myself up during college, so I am going to share what I believe those are.

I saved over $3,000 with these decisions and earned extra money with the others!

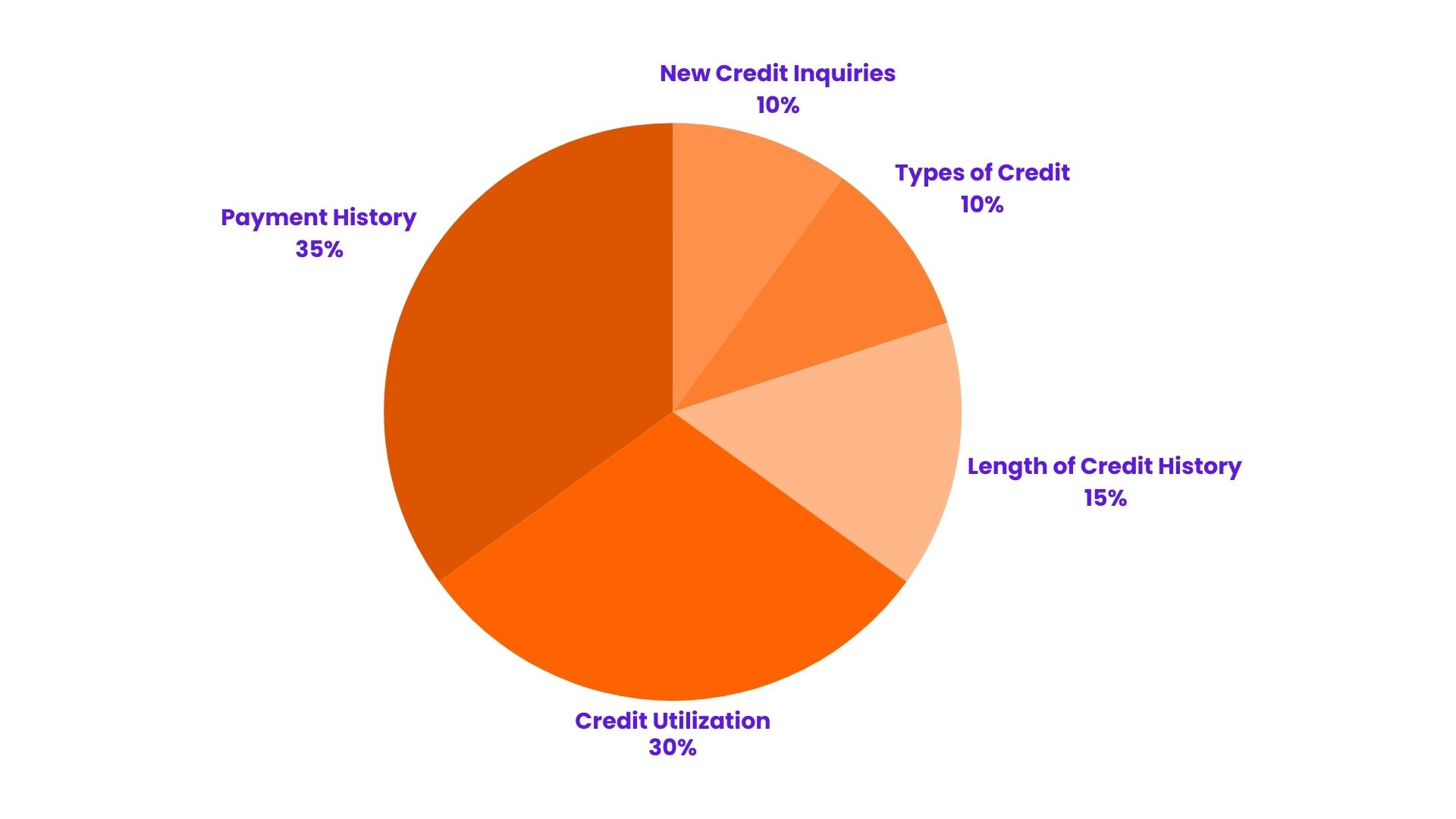

Taking My Credit Score Seriously

Anyone who knows me knows I am obsessed with credit scores and credit cards. Maybe it’s because to me, credit scores are kind of like a grade that you can track how well you are doing financially. But in reality, credit scores are a way that creditors can assess your trustworthiness to give loans, bigger credit lines, and lower interest rates. Starting my freshman year of college, I knew that having a higher credit score would allow me to be more financially independent, not needing anyone to cosign with me on loans, apartment leases, etc. I know that to some people, this might sound frustrating, but it is the harsh reality that exists in the United States.

I opened my first line of credit when I was a freshman in college, and over the past four years, I have managed to get it to a 750. Had it not been for my student loans, I would have been able to achieve around an 800 by the end of college.

Paying Off the Interest on Student Loans

My private student loan was not in a deferment period while I was at school; therefore, I paid the interest every month of college. I spent $128 a month to not be screwed over on the interest by the time I was done with college. The unfortunate thing about student loan interest is that there is this thing called compound interest, where the interest will be added to the principal amount of the loan, and then that increased amount will have interest the following month.

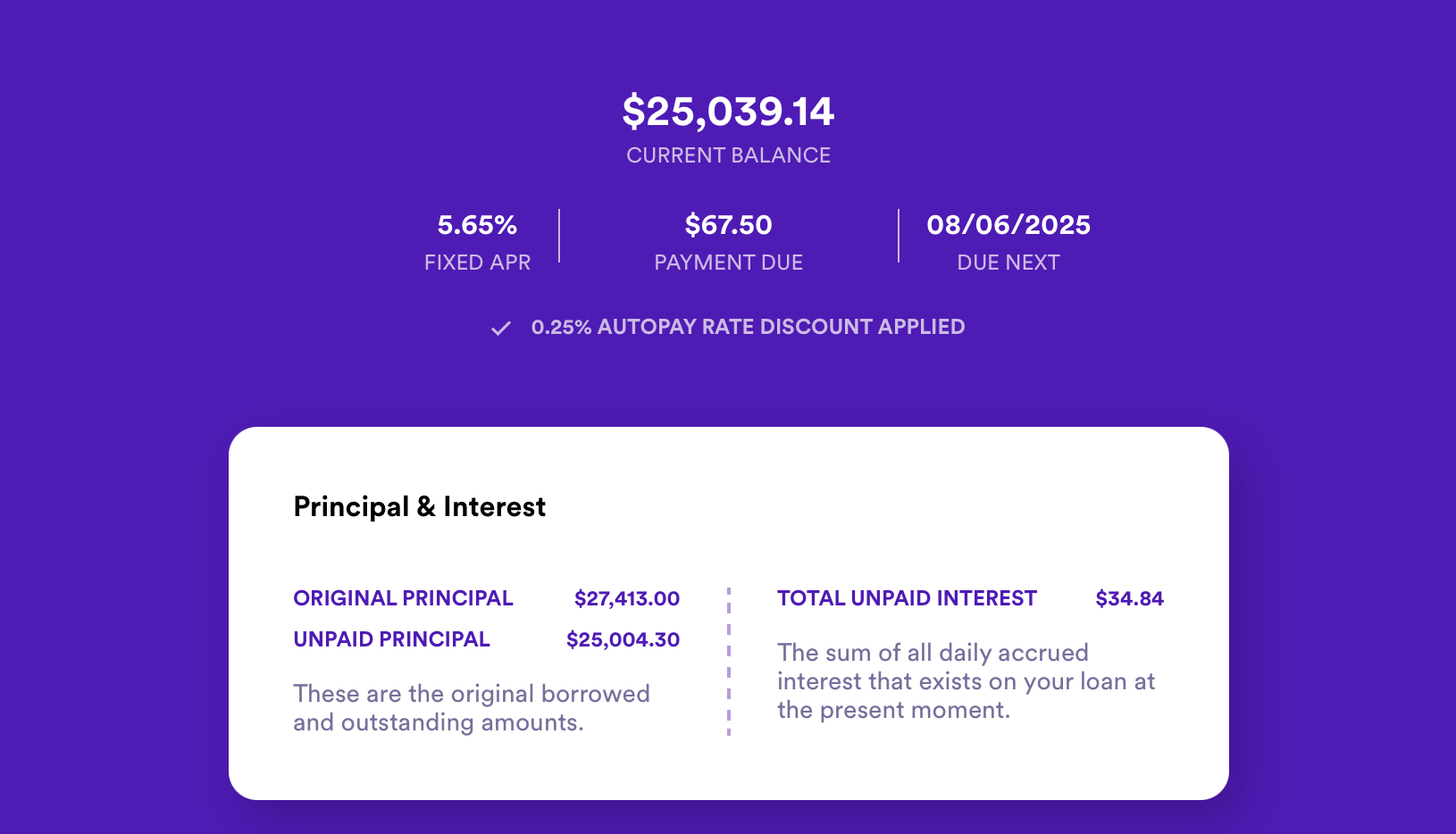

My original private loan through Earnest: $27,413

Monthly payments for the interest: $128

How Much I Paid During College: $5,547

How Much I Saved: $447

While yes, $447 might seem like not a lot in the grand scheme of things, right now my loan amount would be $33,407 if I hadn’t paid any of the interest, and that would be accruing even more interest.

Opening a Roth IRA

Roth IRA: A post-tax retirement account – AKA any growth in the account, you do not get taxed on when you take it out at 59.5.

Right before my Junior year, I opened a Roth IRA through Fidelity. I don’t have a certain amount I put towards it every month, nor do I max it out. But I do put extra money towards it. For the last year, I have put a percentage of my check into this account. The younger you open and invest in this account, the more compound growth it can have in here.

Say you open your Roth IRA at 18 and invest $100 a month

Contribution amount by retirement: $50,400

Balance at Retirement: $223,809

Tax-free growth: $173,409

What if you decide to wait until you are 20 and still invest $100 a month

Contribution amount by retirement: $48,000

Balance at retirement: $196,857

Tax-free growth: $148,857

Those two extra years and $2,400 are a difference of $24,552 in growth

Now, what if you wait until you are out of college and feel secure in your career at 25 to invest $100 a month

Contribution amount by retirement: $42,000

Balance at retirement: $141,745

Tax-free growth: $99,745

Those five years and $6,000 are a difference of $49,112 in growth

Those five years and $6,000 are a difference of $49,112 in growth

I invest a different amount into my Roth IRA every month, depending on my income, so I can’t tell you what my estimated retirement amount will be, but as the models showed above, starting earlier is beneficial to your future self and so I am glad that I got started while I was in college. Also, having this account already set up makes it easier for me to make payments in the future because it takes very little time once you have the account to actually invest money into it.

Cheapest Bedroom

For my last two years of college, my roommates and I would decide which rooms in the house each of us wanted and would make each room cost a different amount based on location, room size, closets, etc. I would select a room based on a “whichever is cheapest” mindset.

In my junior year, none of my roommates wanted the room on the first floor, even though it was the second biggest, because it was attached to the living room and you had to walk through the house for the bathroom (my room to living room, to entryway, to kitchen, then bathroom). I paid $975 for that room, and my roommates each paid $1,100 for their rooms. Yes, that is only $125 difference a month, but when you multiply it by 12 months, I saved $1,500 by having the cheapest room in that house.

During my senior year, two rooms had no closets and faced the nosy street. This year we had three levels of rooms (rooms without closets, rooms with closets, and the biggest rooms with closets). My room was $1,050, the rooms with closets were $1,200, and the biggest rooms with closets were $1,250. Each month, I saved myself $150-$200 a month by having no closet, which saved me $1,800-$2,400 a year. The no closet thing didn’t really bother me because we had some extra racks in the hallway, and I used Walmart plastic bins under my bed for extra storage as well.

Listening to Financial Podcasts

I started doing this way before college, but listening to financial podcasts has altered the way my brain views money and allows me to think about it more big picture. I am a strong believer in “you are what you surround yourself with”. By surrounding myself with financial knowledge and personal finance individuals that have pulled themselves out of debt, become millionaires, etc. I have started to think like them. Financial podcasts are why I even knew to open a Roth IRA, not spend extra money on housing, pay off my student loan interest, and more, while in school.

Using Cash Back Apps on Purchases

I love cash back apps. I view it as if I am already paying for something, I might as well get something in return for this need. The two primary apps I use help give me cash back on groceries and gas.

Groceries (Ibotta)

I have been using Ibotta since I was in high school (since then, they have changed the age requirements to 18+). You can get cash back on a variety of stores and purchases simply by uploading your receipt and matching it to any of the rewards available in the app. Sometimes they even do offers of X% when you spend X amount.

Gas (Upside)

Upside is a newer app for me, but you can get cash back on your gas purchases (and restaurants, but I haven’t used this feature). You just need to make sure you confirm which gas stations it works for and check in on the app before making your purchase. I have made upwards of 20 cents back per gallon. Interested? Use this referral link for an extra 15 cents per gallon on your first gas fill-up and 10% extra cash back on your first restaurant (or code HAYDEN3923)

What are were or are your best financial decisions that would be useful for college students? Feel free to share them in the comment section!