I will reiterate this time and time again on my blog, but I love credit cards, credit scores, etc. I love it because they give me CREDIT for my financial well-being through points, bonuses, cash back, lower interest rates, and so on. Sometimes your financial situation isn’t entirely your fault, but I personally feel like credit cards and credit scores are mostly within the users control, which is why I enjoy being knowledgeable about them and using them to my benefit.

For those of you curious, my current credit score is 764, considered “very good”, which we will get more into later.

However, plenty of people don’t know the basics about a credit score. Today, I will review the key components that make up your credit score and why having a good credit score is important.

Let’s start with the most important piece of a credit score: what is the scoring metric?

Well, a credit score can be anywhere on the scale from 0-850, 0 being the worst and 850 being the best.

300-599: very bad

600-649: poor

650-699: fair

700-749: good

750-799: very good

800-850: excellent

Factors That Influence Credit

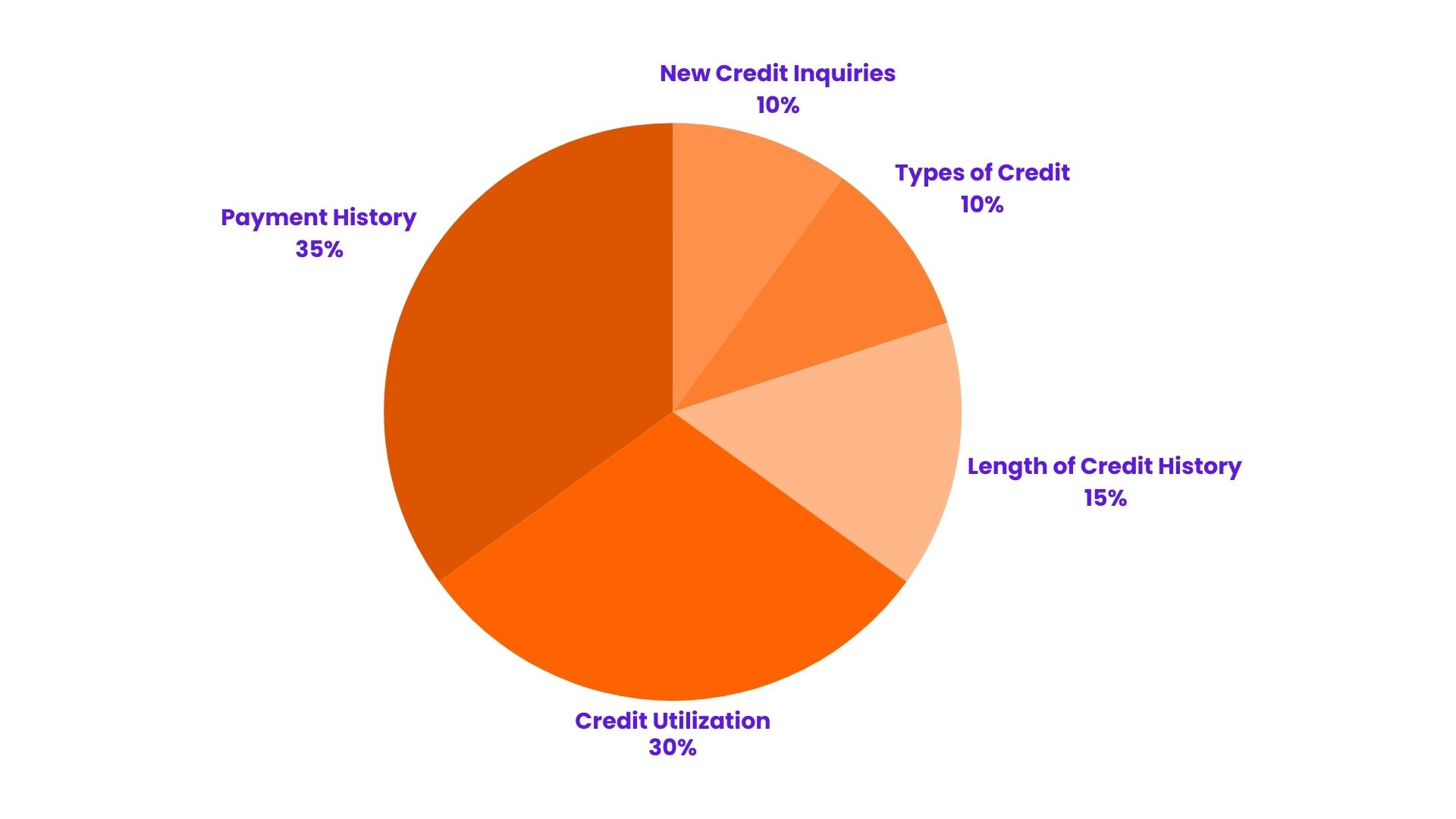

There are five components that your credit score is based on:

- Payment History

Payment history accounts for 35% of your score, primarily focusing on an individual’s track record of making credit payments on time.

- Credit Utilization

Credit utilization comprises about 30% of your score and reflects the amount of credit you’re using compared to the total credit available to you. Keeping this ratio low—typically below 30%—is beneficial for an individual’s score. For example, if the credit available to me on my Bilt card is $1,500, and the recommended ratio is 30%, that means I should not spend more than $450 on my Bilt card each month or have a total balance exceeding that amount. Although the recommended ratio is 30%, I typically try to keep my utilization between 15% and 20% to be extra cautious.

- Length of Credit History

Credit history accounts for roughly 15% of a credit score and refers to the length of your credit history. A longer credit history illustrates a broader picture of your financial behavior, allowing the credit bureaus to assign you a higher score. As a college student, improving this factor can be challenging because it takes time; however, it can also motivate you to open a credit card sooner rather than later. This is why I opened my first credit account my freshman year of college because it allowed me to start building my credit history as early as possible.

- Types of Credit

10% of your score comes from the variety of credit accounts you hold. A mix of different types of credit, such as credit cards, student loans, and car loans, can positively impact your score. I currently have a combination of credit cards and student loans.

- New Credit Inquiries

Last but not least, new credit inquiries account for about 10% of a credit score. Opening multiple new credit accounts within a short period can be seen as risky behavior by lenders, which temporarily negatively impacts your credit score. My rule of thumb is to wait about six months after getting approved for a new credit account before trying to open another.

Why is a Good Credit Score Important?

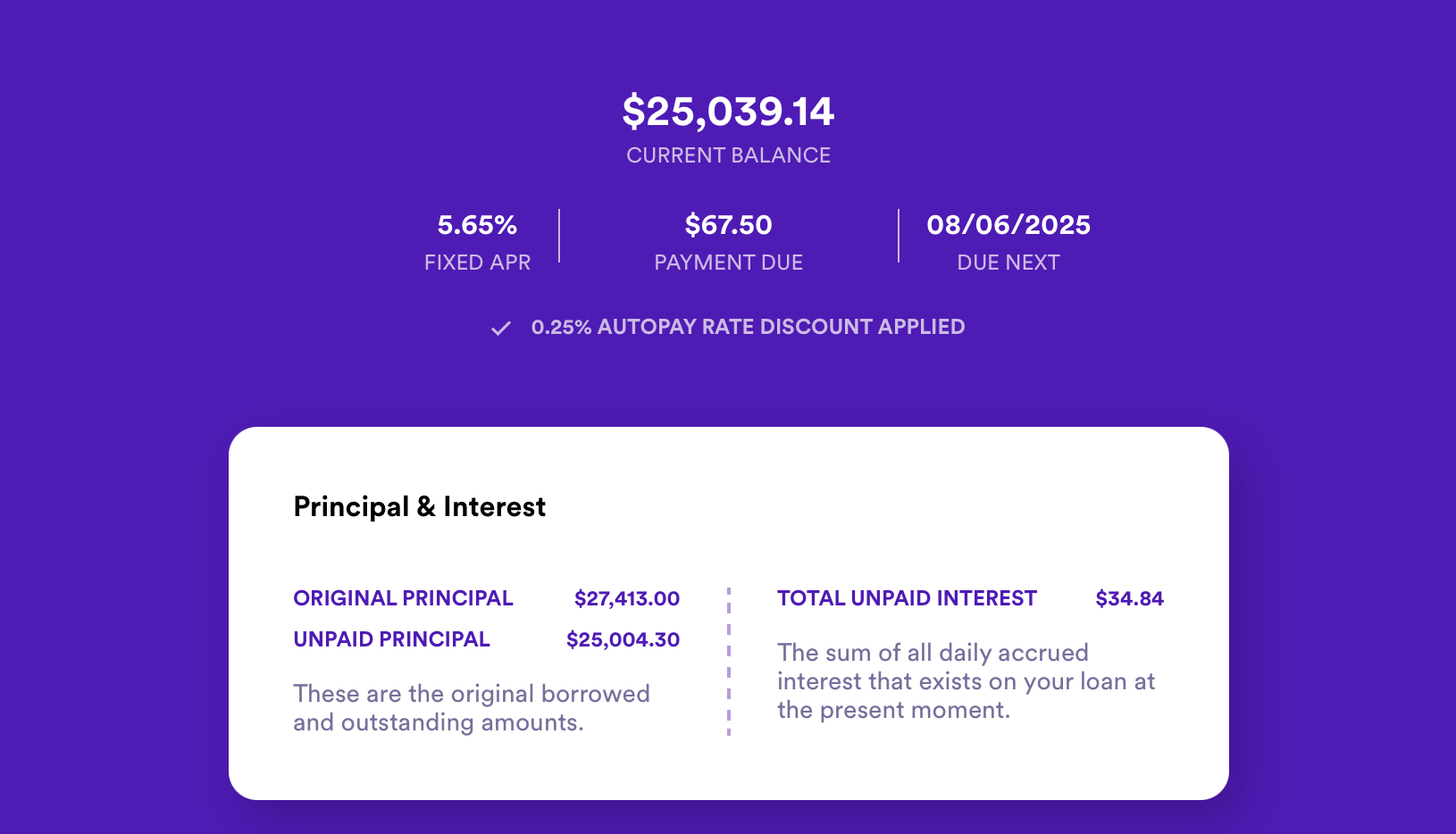

A high credit score is necessary for a multitude of financial milestones. Beyond helping you secure loans for significant purchases, it also influences the interest rate you are offered. A higher score typically results in lower interest rates, possibly leading to substantial savings over time.

Additionally, a higher credit score allows you to avoid needing cosigners in the future for apartments, houses, cars, or any other purchases where there might be a credit check. Therefore, taking your credit score seriously can make you financially independent. Being able to understand the components impacting your credit score can help you establish strategic steps to improve and maintain a strong credit profile.

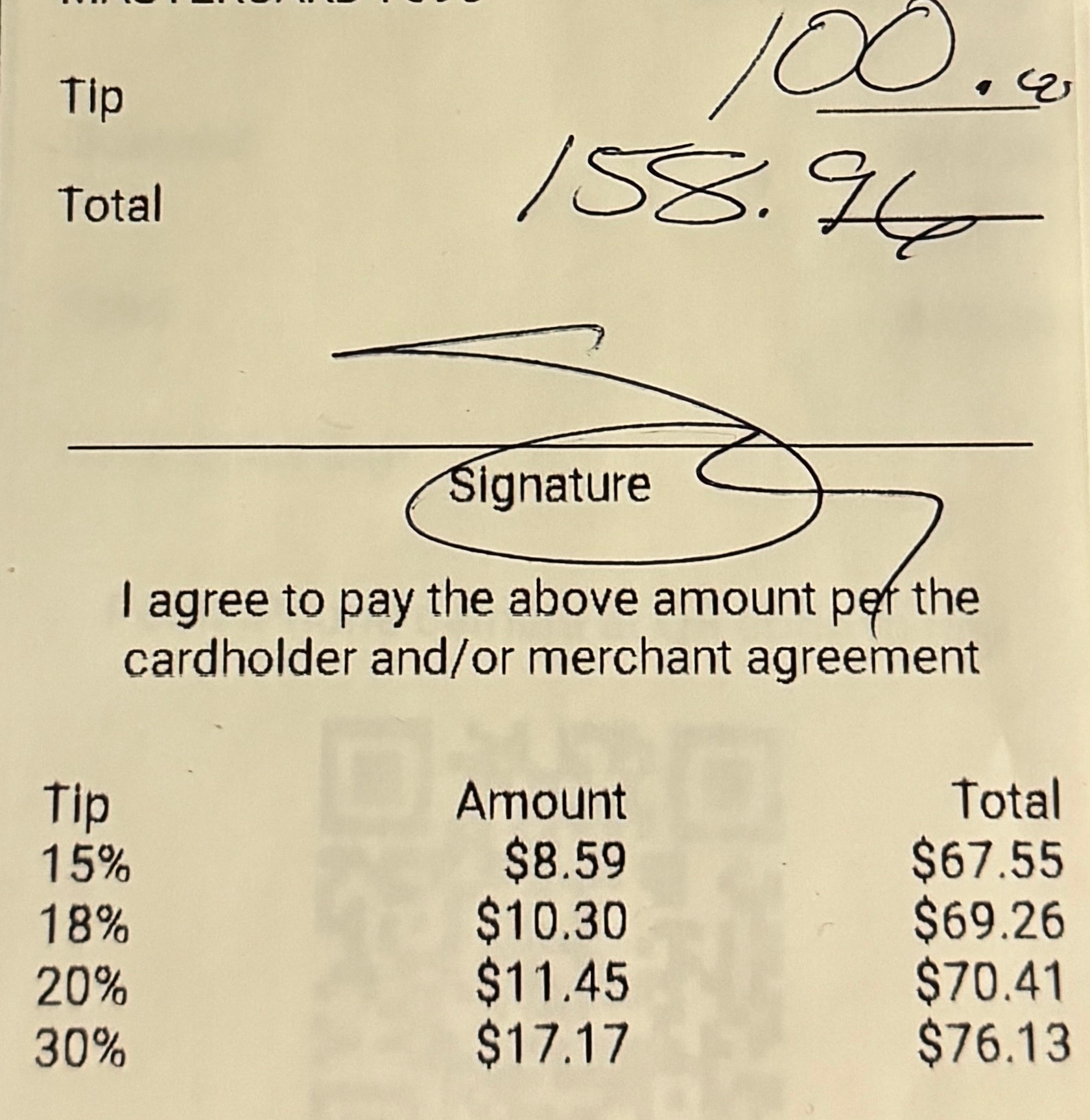

I took a lot of this information directly from the book I wrote on How to Get an 800+ Credit Score in College…you might be thinking, well, Hayden, you don’t have any 800+, which is true, and I address this in the book. When I was a freshman in college, my parents and I cosigned on a private loan that is higher than my yearly income; therefore, making my score lower than it would be without this loan. As I have continued to pay this loan off, my credit score continues to increase.